Introduction

About 833 wordsAbout 3 min

Strategic-Finance supports companies in the realistic financial evaluation of their investment projects, particularly for innovative products or services, new technologies (e.g., AI), new markets, M&A, internal transformation, and operational resilience.

All these new business opportunities are attractive but also uncertain. Therefore, they are often approached with adaptability (agility) to mitigate risks. We offer the appropriate financial valuation method: modern real options.

Real options are important because they realistically represent adaptive business cases and thus provide the basis for well-informed investment decisions. The NPV, on the other hand, would be an unrealistic representation, which could easily lead to unnecessary missed opportunities. Adding safety margins to the NPV would only exacerbate the situation.

To easily and reliably integrate modern real options into existing processes such as business case analysis and portfolio prioritization, Strategic-Finance offers training and coaching, as well as the appropriate software: the Real Options Calculator (ROC).

When to use Adaptability?

When significant uncertainty exist, it is advisable to design projects in an adaptable manner. Signs of “significant” uncertainty are:

- NPV can turn negative for reasonably pessimistic scenarios.

- Doubts let decision makers add security margins to the NPV calculation: higher WACC (“hurdle rate”), higher costs, longer durations, lower revenues.

- Resolving uncertainties requires a non-negligible investment in time and/or money. For that reason, these activities must be integral part of the business case and the investment decision.

- Business case owners perceive opportunities (options) they cannot express in the NPV framework.

When facing significant uncertainty, it is advisable to avoid all-or-nothing decisions and to invest stepwise instead. Each step means making progress and learning new things. This learning enables choosing the optimal next step. The project is executed in an adaptive and thus risk-minimizing way.

Accordingly, adaptability (agility) has value. And this value is higher the greater the uncertainty.

Why Real Options?

Each step in an adaptive (agile) project can be viewed as an option on the next step, or as an option on a financial ROI. Accordingly, the appropriate financial valuation method is called "real options."

Adaptability results in a multitude of possible project trajectories and ROI scenarios. These trajectories can be illustrated using tree structures (see Use Cases). Such tree structures are explicit representations of "uncertainty."

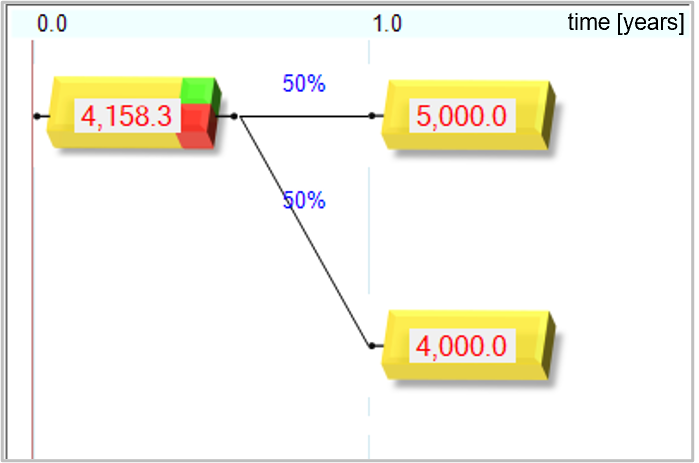

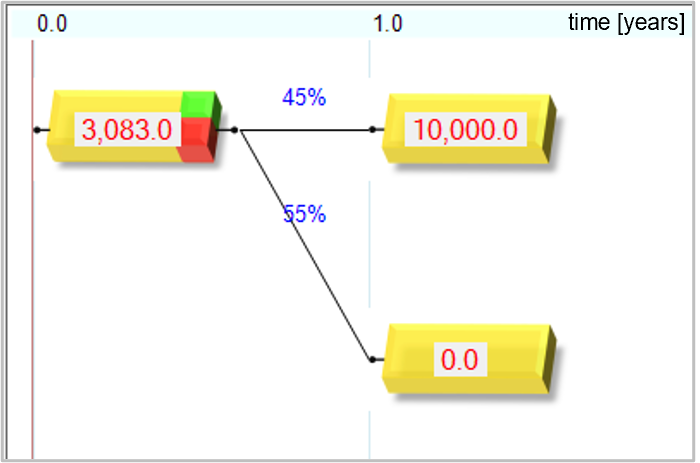

Uncertainty has a significant impact on valuation: Low-risk businesses have a higher value than high-risk ones. Real options capture the explicit representation of uncertainty and thus achieve a fair, risk-adjusted valuation, see the following example.

|  |

|---|---|

| Real Options Valuation for low -Risk Case | Real Options Valuation for high-Risk Case |

In contrast, NPV cannot capture explicit uncertainty because it works with an implicit representation of uncertainty, namely the constant risk premium in the WACC. Therefore, NPV would arrive at the same valuation for both situations shown above, despite the significantly different risks. This is unacceptable, as the true values can be very different.

Applying the NPV can therefore lead to incorrect decisions. Even the use of safety margins (higher WACC, higher costs, lower ROI) is not a solution here, as these would be approximate at best.

What Business Processes do benefit?

- Business Casing: Crafting adaptive projects for optimum value creation. Typical strategies include: fail-fast, fail-cheap, defer big investments until resolution of uncertainties, parallelization.

- Portfolio Prioritization: Frequent optimization of resource allocation for maximum value creation.

- Annual Project Budgeting: Right-sizing as per financial objectives.

Ease of Implementation

Real options are highly compatible with existing corporate processes. They can be used in parallel or combined (hybrid), both for business casing and portfolio prioritization. No organizational changes are required, and implementing real options is straightforward.

Creating adaptive business cases is an evolution of the familiar business casing process: Business assumptions are formulated in the same way, but supplemented by descriptions of possible outcomes after each step and their probabilities. This facilitates consensus among all stakeholders on the business assumptions.

Regarding portfolio prioritization, the ROC software integrates financial, operational, and strategic descriptions. This ensures alignment of financial, operational and strategic priorities.

Who are Typical Users?

Typical users include:

- Decision-makers, Strategy, Finance

- Portfolio Management (PMO) / Value Management (VMO)

- Innovation Management

- Operational / Supply Chain Management

- LACE (SAFe®)