Round Trip

About 367 wordsAbout 1 min

The Real Options Calculator (ROC) guides you through a complete, professional round trip for designing, evaluating, and optimizing your innovation or transformation projects. Here’s how a typical project flows through the tool:

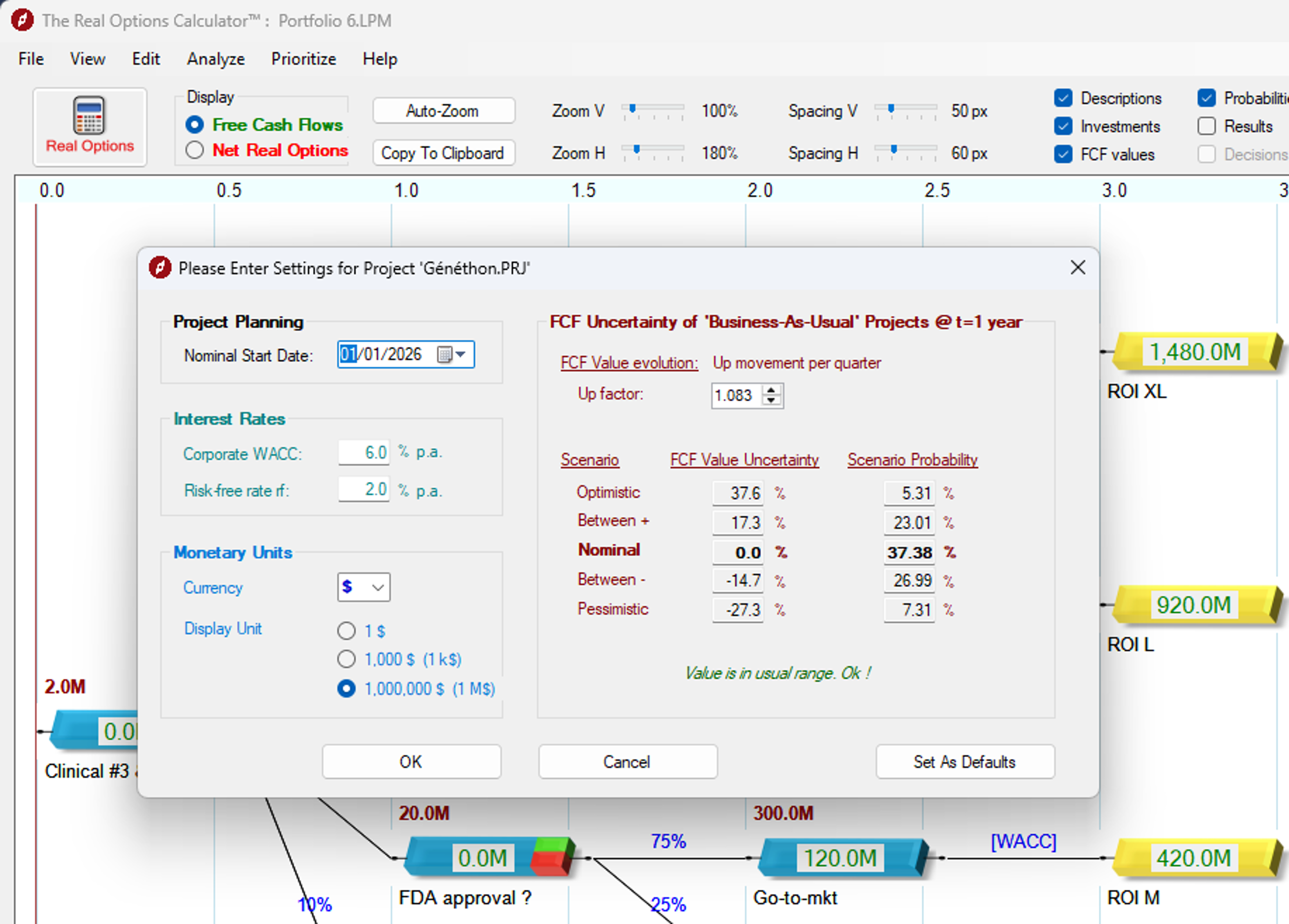

1. Define Project Parameters

Begin by entering essential financial settings for your project:

- Go to

Edit > Project Settings - Input WACC (Weighted Average Cost of Capital), rf (risk-free rate), and Currency

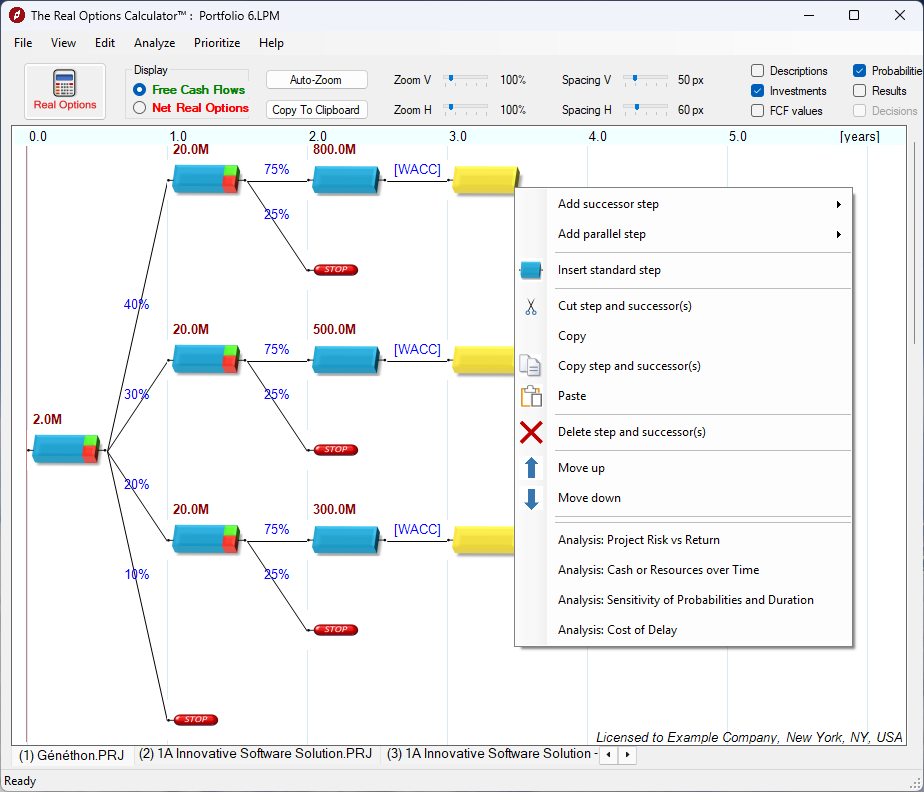

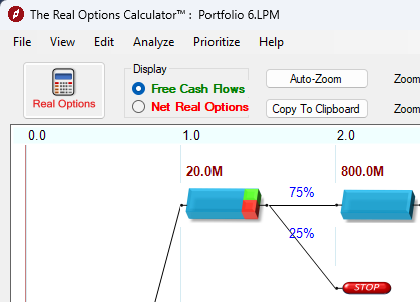

2. Structure Your Project

Build the project tree to reflect each stage, milestone, or decision point:

- Right-click on a project step to add, edit, or remove steps

- Map out the sequence of actions and uncertainties

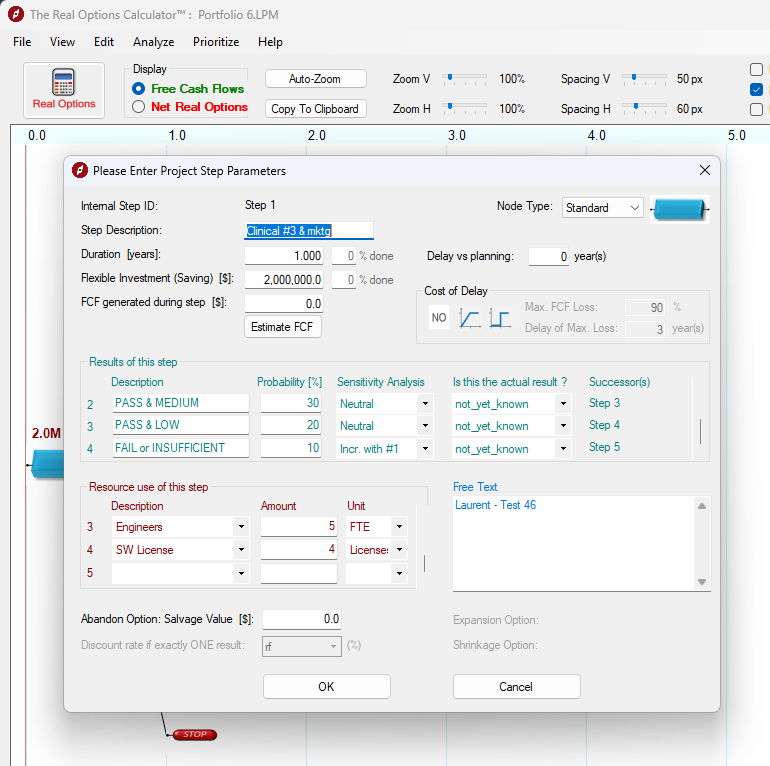

3. Detail Each Step

For every step in your project:

- Specify duration, required investment, probabilities of outcomes, and expected Free Cash-Flow (FCF)

- Left-click a step to open its detailed parameters

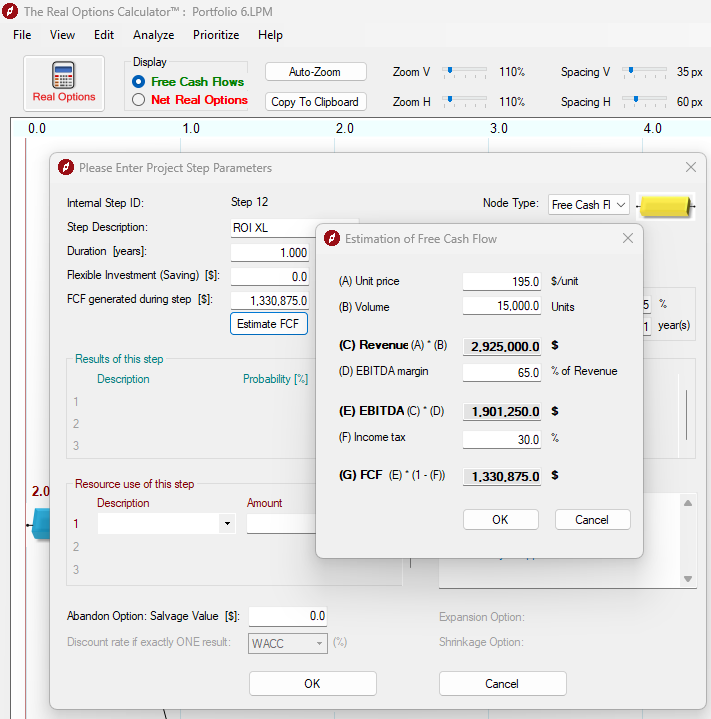

4. Estimate Scenario Outcomes

Use the built-in estimator to model different financial outcomes:

- Click ‘Estimate FCF’ to input assumptions and calculate projected cash flows for each scenario

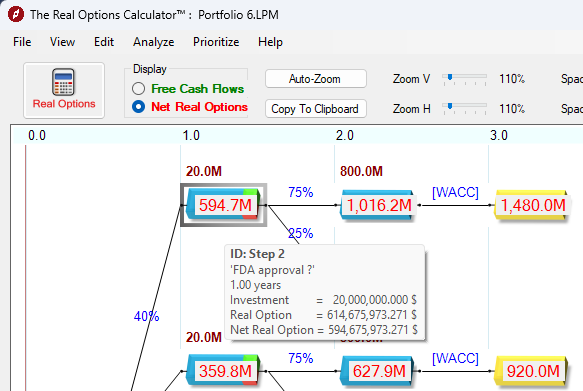

5. Calculate Real Option Values

Quantify the value of flexibility and staged investment:

- Click the ‘Real Options’ button to compute Net Real Option values for each step

6. Review and Export Results

- Visualize Real Options values directly on the project tree

- Hover for tooltips with detailed values

- Use ‘Copy to Clipboard’ or

File > Saveto export your results

7. Iterate and Optimize

- Adjust assumptions, project structure, or parameters as needed

- Recalculate to compare scenarios and optimize your business case

Summary

This round trip enables you to:

- Rapidly design and evaluate complex projects

- Make informed, risk-aware investment decisions

- Communicate results clearly to all stakeholders

For more details, see our Project Design Guide or contact welcome@strategic-finance.eu.