New Product & Service

About 473 wordsAbout 2 min

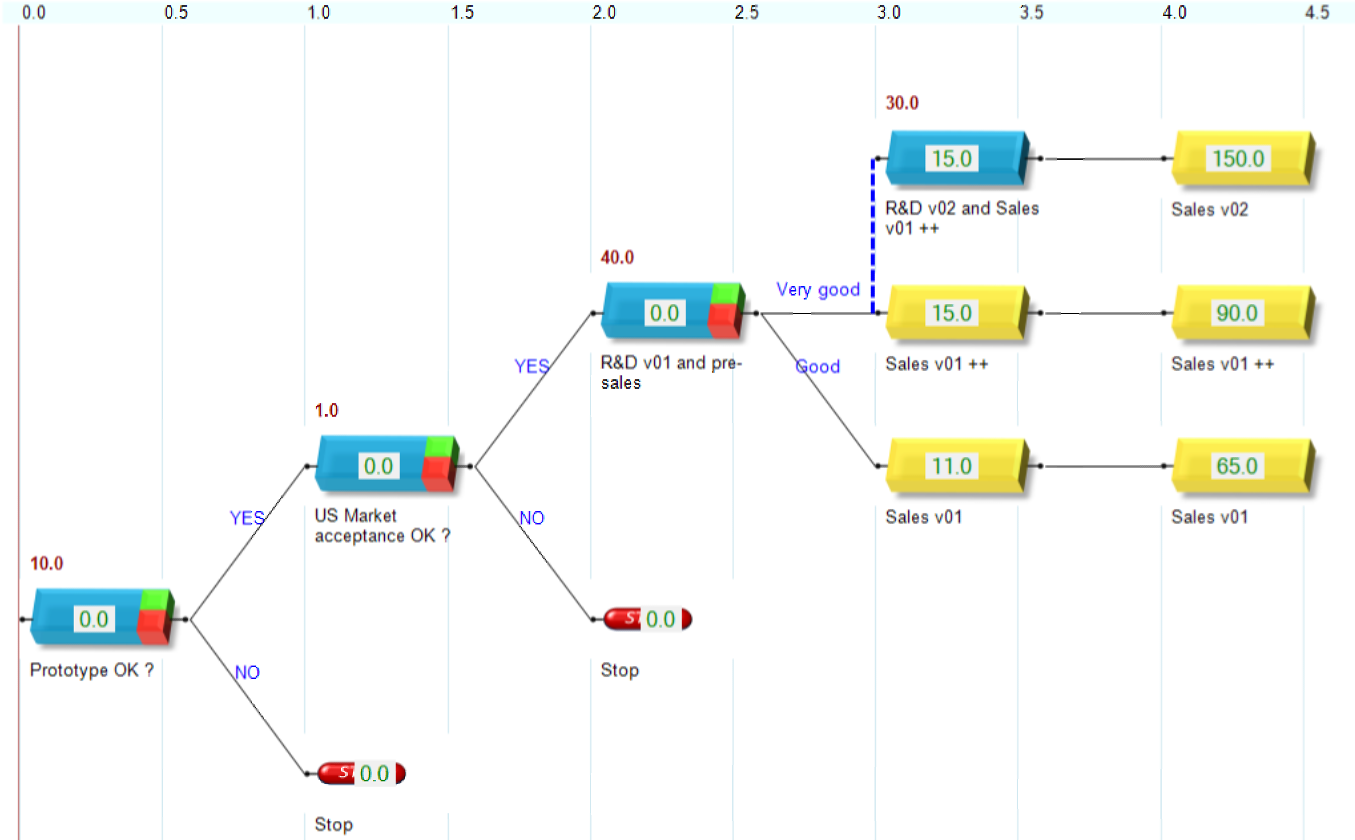

Introducing a new product or service to the market is inherently uncertain. Fortunately, adaptability (agility) helps to handle uncertainty effectively. The key is to design project steps (see blue bricks) that resolve some uncertainty. The resulting discovery then informs the best next step to take, until reaching an outcome (ROI, see yellow bricks), including possibly the ideal one. Other choices include early stopping (see red tokens), persevering (see dashed line), shrinking, abandoning, switching, pivoting – you name it.

| ROC Capabilities | Benefits |

|---|---|

| Fast and transparent design of adaptive (agile) projects, support of any complexity | Fast consensus on business assumptions, enabling meaningful financial valuation and decision-making |

| Integrating operational and financial data | Financial decisions are rooted in operational realities |

| Integrating financial and strategic data | Financial decisions represent strategic considerations, ensuring alignment between strategic and financial priorities |

| Fast re-design of adaptive (agile) projects | Optimization of project design for greatest value creation |

| Financially sound evaluation and analysis using modern Real Options valuation | • Risk reduction • Seizing opportunities that would be missed using NPV • Speed in decision-making Test |

Related Topics

- Typical Workflows for designing adaptive (agile) projects: Quick Start > Project Design

- Typical Choices: Quick Start > Project Design > Typical Choices

- More on Benefits: Benefits

Main Points

- Explicitly Manage Uncertainty:

The stepwise approach makes uncertainties and adaptation needs visible at every stage, allowing for informed go/no-go decisions. - Discovery-Driven Design:

ROC supports designing projects that validate key assumptions early, minimizing risk and enabling fast learning.

How ROC Supports New Product Introduction

- Map Out Assumptions and Steps:

Break down the product introduction into sequential steps, each resolving a key uncertainty (e.g., market fit, technical feasibility, regulatory approval). - Model Scenarios:

Use parallel branches to represent alternative outcomes (success, partial success, failure) and quantify their probabilities and financial impacts. - Stage Investments:

Defer major investments until critical assumptions are validated, reducing risk and enabling “fail fast” learning. - Optimize Decisions:

At each stage, use ROC’s real options valuation to decide whether to proceed, pivot, or stop, based on updated information.

Example Workflow

- Step 1: Validate market need with a pilot or MVP.

- Step 2: Assess technical feasibility and refine the product.

- Step 3: Scale up production and launch, only if previous steps are successful.

Benefits

- Transparent, data-driven decision-making

- Reduced risk through staged investments

- Faster adaptation to market feedback