New Technologies

About 336 wordsAbout 1 min

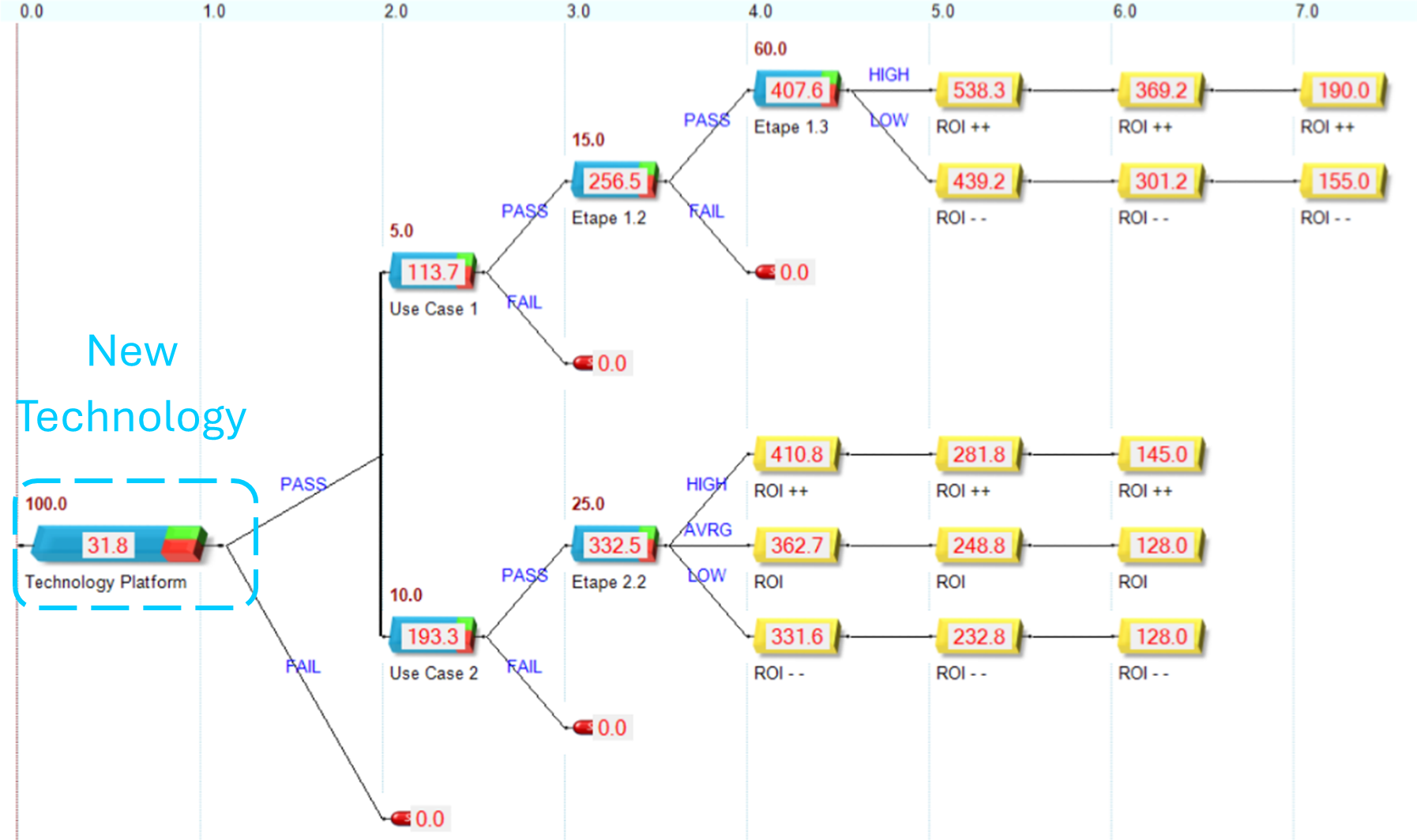

How to justify the value creation of new technology, like e.g., AI, big data platforms, reduction of technical debt (SAFe®: Enabler Epic)? The key lies in the recognition that while new technology may not lead to immediate financial benefits, it does enable commercial use cases that do have direct financial benefits. In other words, new technology creates an option on the value of the supported commercial use cases. Indeed, while these use cases will be novel and therefore uncertain, they will have value nevertheless (see Use Cases > New product & service Introduction).

Main Points

Note: For simplicity, New Technology development or deployment is shown as monolithic. In general, though, a stepwise approach is taken here as well.

- Value of Flexibility:

Investment in new technology is justified by the value of the real option it creates for future commercial use cases. - Scenario Analysis:

ROC enables you to model multiple future scenarios—such as successful adoption, partial success, or failure — and quantify their financial impacts. - Staged Investment:

Defer major investments until key technical uncertainties are resolved, reducing risk and enabling “fail fast” learning. - Informed Go/No-Go Decisions:

At each stage, ROC’s real options valuation supports decisions to continue, pivot, or stop based on updated information.

How ROC Supports New Technology Investment

- Map Out Key Uncertainties:

Break down the technology development into sequential steps, each resolving a critical uncertainty (e.g., technical feasibility, integration, production). - Model Commercial Scenarios:

Use parallel branches to represent different commercial outcomes and quantify their value. - Stage Investments:

Allocate resources in phases, committing larger investments only after key uncertainties have been resolved. - Optimize Portfolio Impact:

Determine which commercial use cases should be implemented with priority.

Benefits

- Fast and rational decision-making about technology investments

- Transparent, discovery-driven technology investment decisions

- Reduced risk through staged investments and scenario modeling