Merges & Acquisitions

About 386 wordsAbout 1 min

Mergers and acquisitions (M&A) are high-stakes decisions, often made under significant uncertainty about the future value of the target company. The Real Options Calculator (ROC) enables you to structure M&A deals that maximize value and minimize risk. This is achieved by incorporating adaptability based on earnout clauses.

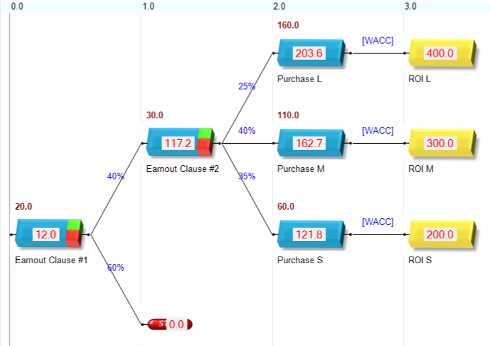

The earnout clauses implement a flexible bidding process for the acquisition of a target company. This results in the rightsizing of the overall acquisition price in accordance with the proven performance of the target company. This is satisfactory for both parties, and more competitive than rigid bidding based on average assumptions.

Main Points

| M&A without earnout clauses | M&A with earnout clauses |

|---|---|

|  |

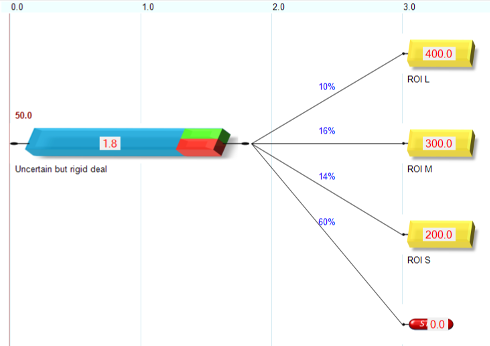

- Traditional M&A:

Without earnout clauses, M&A is essentially a bet on the future value of the target company, exposing the acquirer to significant risk if assumptions prove incorrect. - Earnout Clauses:

Flexible bidding with earnout clauses is more competitive than traditional NPV-based approaches, allowing buyers to link payments to actual performance and reduce financial risk. - Real Options Approach:

ROC helps you model alternative deal structures, quantify the value of flexibility, and make informed go/no-go decisions at each stage.

How ROC Supports M&A

- Model Deal Scenarios:

Break down the acquisition into sequential steps (e.g., initial payment, performance milestones, earnout triggers). - Quantify Uncertainties:

Use parallel branches to represent different post-acquisition outcomes and their probabilities. - Stage Payments:

Defer a portion of the purchase price to future milestones, aligning incentives and reducing upfront risk. - Optimize Bids:

Use ROC’s real options valuation to design bids that are both competitive and risk-aware.

Example Workflow

- Step 1: Initial acquisition with partial upfront payment.

- Step 2: Earnout payments triggered by achieving specific financial or operational targets.

- Step 3: Final integration and realization of synergies.

Benefits

- Competitive, adaptive deal structures

- Reduced risk through staged payments and earnouts

- Transparent, data-driven decision-making