Scenario Based Strategic Planning

About 551 wordsAbout 2 min

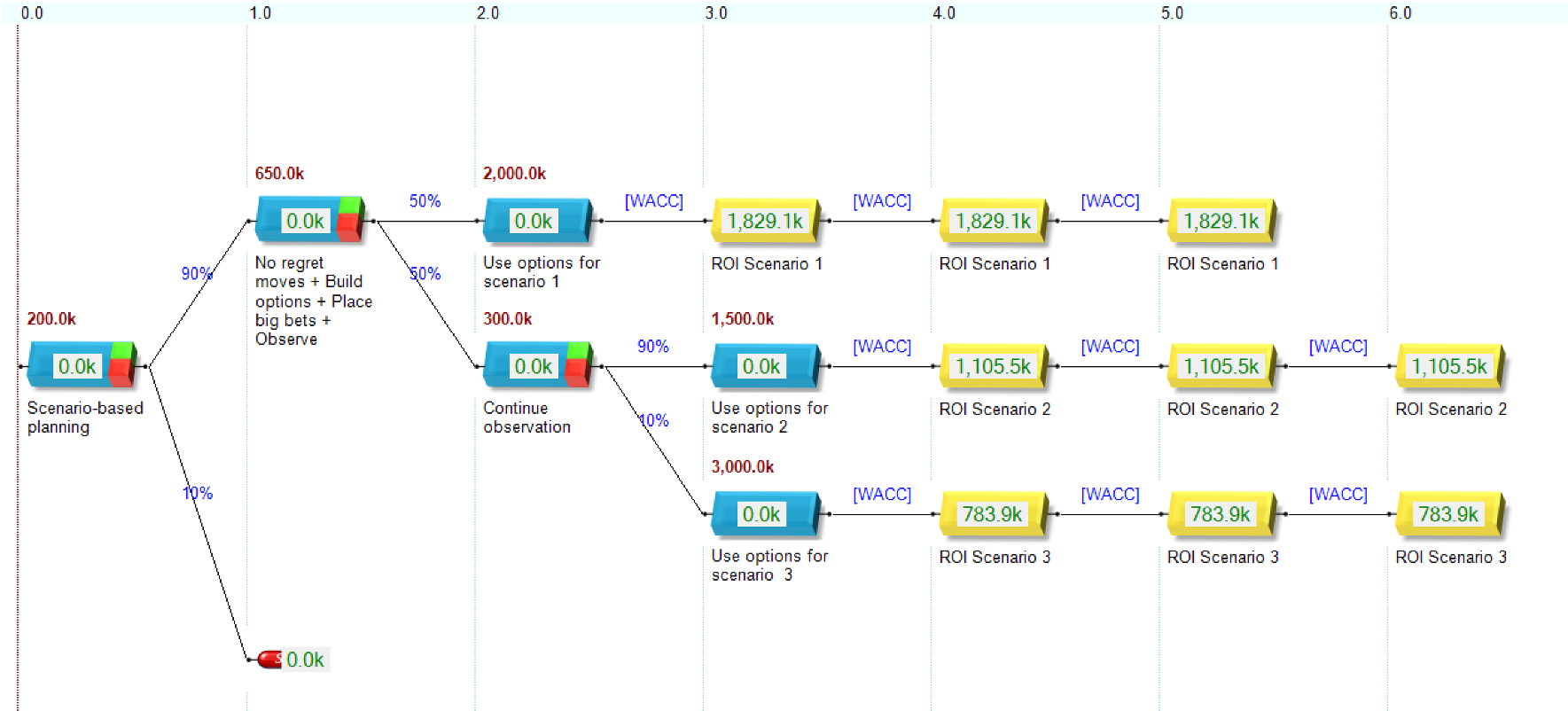

Scenario-based strategic planning enables organizations to make robust decisions under uncertainty by modeling alternative futures (foresight). For each of such futures or “scenarios”, the required strategic moves are determined. On this basis, the strategic moves are classified:

- No regret moves: These moves are common to all scenarios. Thus, the organization can readily invest in their implementation.

- Optional moves: These moves are specific to one or several scenarios, but not to all. Accordingly, the organization is not sure whether it will be necessary to invest in implementing these moves. To avoid major investment risks, organizations strive to just prepare for these moves. Only if they are known relevant, will these moves be fully implemented.

- Big bets: Like with optional moves, these moves are specific to some scenarios only. However, optionality cannot be created, for example due to a lack of early observation capabilities about what scenario unfolds. Investing in all these remaining moves is typically too expensive and risky. Therefore, a bet is taken on some of them, the others are left unaddressed.

In summary, organizations can readily invest in (a) No regret moves, (b) Building options, (c) Big Bets, and (d) Observation capabilities about what scenario unfolds. Afterwards, observation takes place to trigger the full implementation of the suitable optional moves, or to continue observation.This way, the organization performs its strategic moves in the most adaptable and cost-effective manner possible.

Once these moves are completed, the organization disposes of the required competitive advantages and core competencies to successfully pursue sustainable, profitable growth. The according financial returns are represented by the sum of the returns of all portfolios. The Real Options Calculator (ROC) fully supports this approach.

Main Points

- Decision-Making Under Uncertainty:

Scenario-based planning allows you to anticipate a range of possible outcomes and prepare adaptive strategies, rather than relying on a single forecast. - Model Multiple Future Scenarios:

Use ROC to create parallel branches for different scenarios — such as market shifts, regulatory changes, or technological breakthroughs — and assign probabilities and financial impacts to each. - Evaluate Financially the Strategic Moves:

ROC helps you evaluate the benefits of keeping options open, deferring commitments, or pivoting as conditions change. - Informed Go/No-Go Decisions:

At each stage, ROC’s real options valuation supports data-driven decisions to proceed, adapt, or halt initiatives based on updated scenarios.

How ROC Supports Scenario-Based Planning

- Map Out Key Uncertainties:

Identify critical uncertainties and structure your plan to resolve them in stages. - Model Alternative Scenarios:

Build parallel branches for each plausible future, quantifying their likelihood and impact. - Stage Investments and Actions:

Defer major commitments until key uncertainties are resolved, reducing risk and enabling agile responses. - Optimize Strategic Choices:

Use ROC’s valuation to compare strategies and select the path with the highest expected value.

Example Workflow

- Step 1: Identify key uncertainties and define alternative scenarios.

- Step 2: Model the financial and operational impact of each scenario.

- Step 3: Use ROC to evaluate options and inform strategic decisions as new data emerges.

Benefits

- Robust, adaptive strategies for uncertain environments

- Transparent, data-driven decision-making

- Reduced risk through staged commitments and scenario modeling