Operational Resiliency

About 315 wordsAbout 1 min

Operational resiliency is critical for organizations facing supply chain disruptions, cyber security risks, and other operational risks. The Real Options Calculator (ROC) enables you to quantify the value of investing in resiliency measures, supporting data-driven decisions that balance cost and risk.

Main Points

| Without resiliency | With resiliency |

|---|---|

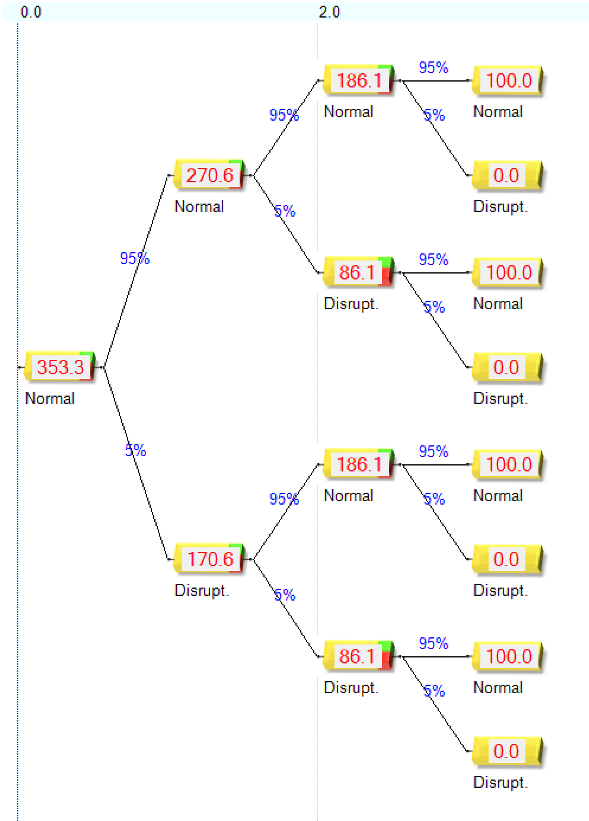

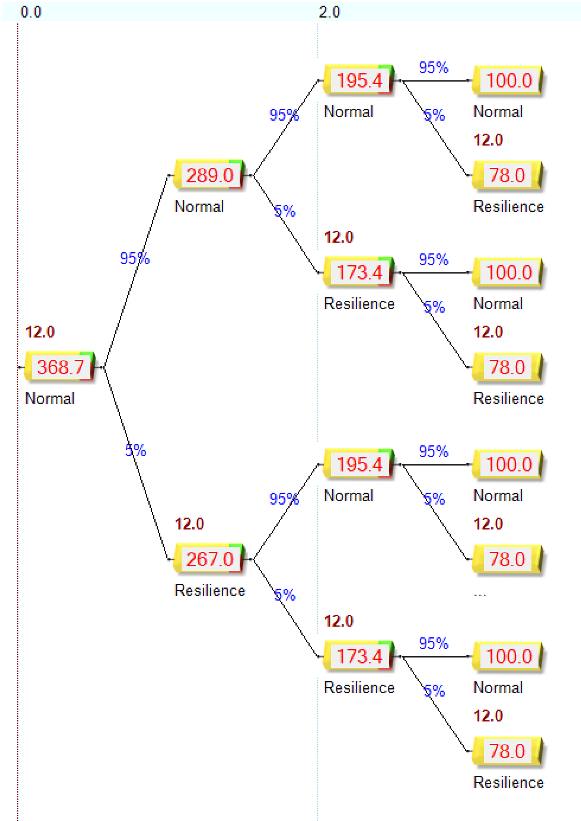

|  |

- Supply Chain Disruption Risk (No Resiliency):

Without resiliency measures, organizations are exposed to significant risk from supply chain disruptions, potentially impacting financial performance and operational continuity. - Supply Chain Disruption Risk (With Resiliency):

Implementing resiliency strategies — such as alternative suppliers, inventory buffers, or adaptive contracts — reduces risk and can increase the overall value of operations. - Quantified Benefit:

In this example, the situation with resiliency is worth 368.7, compared to 353.3 without. The net benefit of creating resiliency is 15.4, justifying the investment.

How ROC Supports Operational Resiliency

- Model Disruption Scenarios:

Use ROC to map out potential disruption events and their financial impacts, both with and without resiliency measures. - Quantify Value of Resiliency:

Compare scenarios to determine the incremental value provided by resiliency investments. - Stage Investments:

Plan and prioritize resiliency measures, deferring major costs until critical risks are validated. - Optimize Decisions:

Use real options valuation to decide when and how much to invest in resiliency, based on updated risk assessments.

Example Workflow

- Step 1: Assess baseline risk and potential disruption impacts.

- Step 2: Identify and evaluate resiliency strategies.

- Step 3: Implement selected measures and monitor outcomes.

Benefits

- Data-driven justification for resiliency investments

- Reduced operational and financial risk

- Transparent comparison of alternative strategies