Maximize Value Creation

Shape adaptive (agile) projects and prioritize portfolios. This financial optimization increases value creation significantly and quickly.

This financial evaluation method truly reflects adaptability (agility), whether for investments, timelines, or outcomes. It models dynamic investments, freeing you from the high and approximate safety margins commonly applied to traditional NPV calculations.

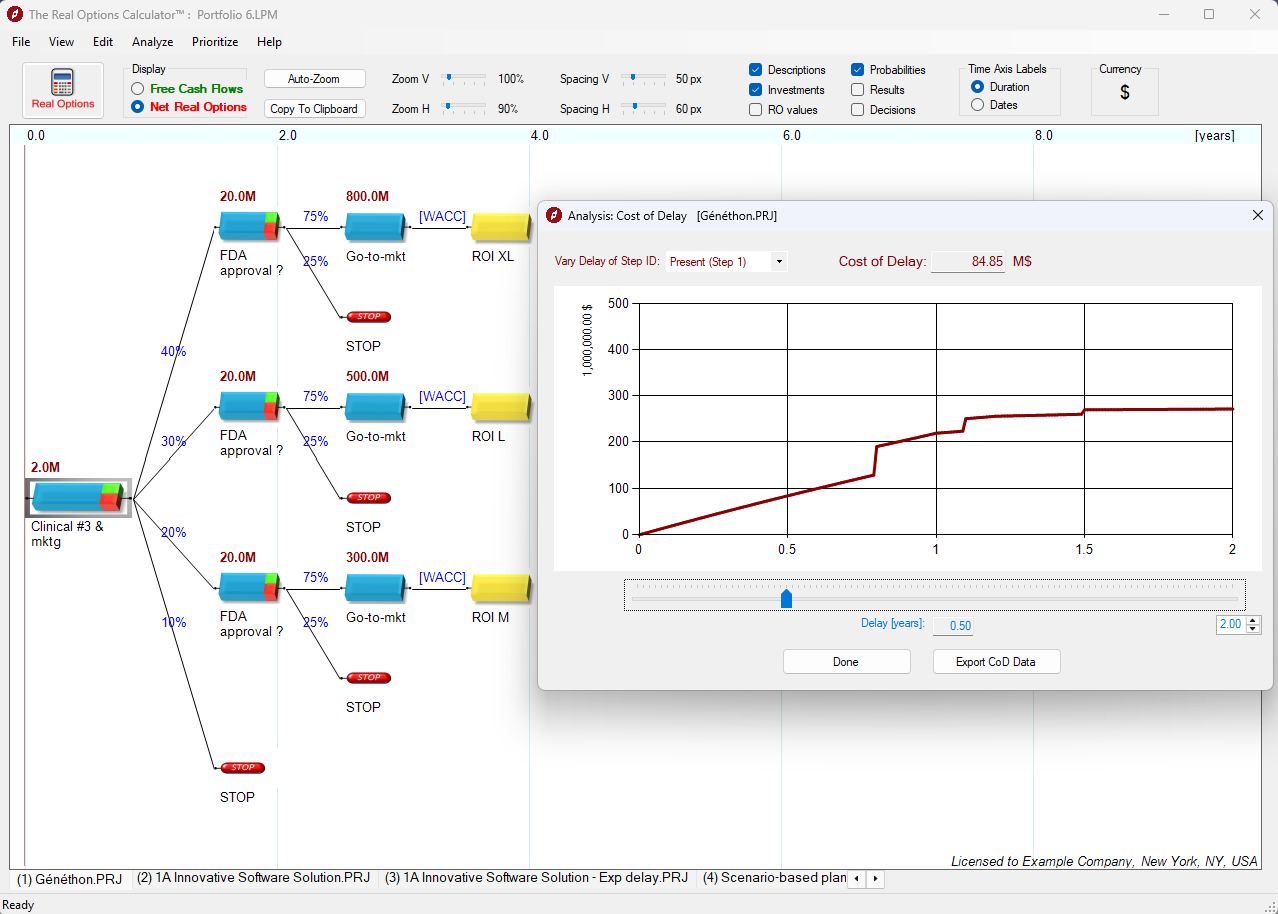

Strategic-Finance extends your evaluation and decision-making processes by the Real Options method. It supports Waterfall and V-Cycle development, SAFe®, LeSS, Scrum at Scale, Lean-Startup, ISO 56001, and ORK.

For easy, reliable, and cost-effective integration, we offer training, coaching, and our advanced Real Options calculation software.

Ready to reinforce your investment decision-making? We support you at every step, from initial training to coaching, including the deployment of our Real Options Calculator (ROC) software.

PoC on Business Casing

Move from NPV to Real Options.

Pilot Project on Financial Portfolio Prioritization

Experiment the concepts, process, and benefits.

Core Team Training

Decision-makers, Strategy, Finance, Innovators, LACE / PMO / VMO: Master the concepts of real options and the ROC software. Optimize value creation at project and portfolio levels. Ensure strategic alignment.

Coaching on Real Options Implementation

Supporting your teams in integrating real options into your strategic, financial, accounting, and agile management processes.

Ad-hoc Business Support

Your Contact in Europe

Strategic-Finance SAS

06560 Sophia-Antipolis – France

Your Contact in the US

Outcomes360 LLC

Apopka, FL 32712 – USA

What are Modern Real Options?

Why do Modern Real Options matter?

How much effort and time does it take to deploy Modern Real Options?

What is the NPV from implementing Modern Real Options?

What kind of portfolios do benefit from this solution?

Do I need to be an expert in finance to reap the benefits from this solution?